Economic Snapshot

August 2025

Summary

Global and domestic equity markets posted solid gains in August, buoyed by resilient corporate earnings and growing expectations of further interest rate cuts. Commodity performance was mixed, with iron ore and gold advancing while oil retreated. In fixed income, US bond yields declined as markets brought forward expectations of rate cuts, though investors remained cautious, awaiting clearer economic signals before factoring in additional policy adjustments.

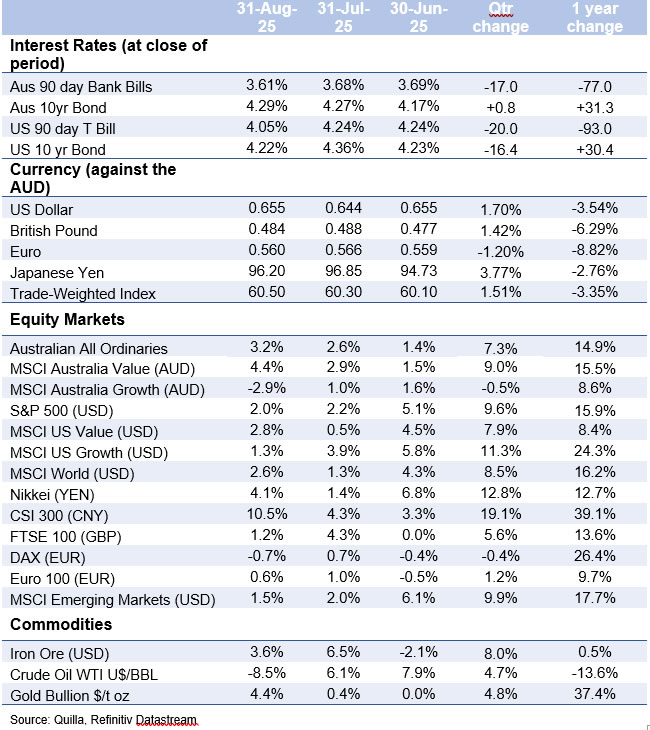

Selected market returns (%), August 2025

Sources: *FTSE EPRA/NAREIT DEVELOPED, **FTSE Global Core Infrastructure 50/50 Index

Key market and economic developments in August 2025

Financial markets

Global equity markets continued to deliver strong performances in August, with the MSCI World (USD) up 2.6%. The broad rally can be attributed to improved investor sentiment due to the increased probability of interest rate cuts, as well as solid company earnings continuing to support equity markets. US bond yields declined, driven by weaker-than-expected employment data.

Australian equities

The ASX 200 rose 3.2% in August, bringing the calendar year-to-date (YTD) return to 12.3%. The company reporting season dominated the news flow and share price movements, with most sectors delivering positive returns for the month. The strongest returns came from the Materials, Consumer Discretionary and Utilities sectors, delivering returns of 9.2%, 7.6% and 5.3% respectively. Healthcare and Information Technology underperformed, returning -13.2% and -1.7% respectively.

The reporting season delivered generally strong earnings, with a greater number of companies exceeding profit expectations than falling short, underscoring the resilience of the Australian economy. Other notable takeaways included earnings beats largely driven by stronger-than-expected margins rather than revenue growth, highlighting companies’ effective cost management, while healthy balance sheets supported a surprising rise in dividends and share buybacks.

Global equities

Broad strength was seen across global equity markets, driven by robust corporate earnings and improved investor sentiment. In the US, the S&P 500 Index (USD), Nasdaq Composite (USD), and Russell 2000 Index (USD) rose 2.0%, 1.6% and 7.0% respectively, signalling a rebound in smaller companies that had lagged in performance recently. On a sector basis, Consumer Staples and Telecommunications were the best performing, returning 4.2% and 3.4% respectively.

Second quarter 2025 earnings from US companies exceeded expectations, alleviating concerns over a potential slowdown in economic growth. 81% of the S&P 500 companies reported a positive earnings and revenue surprise, the highest since the second quarter of 2021. The yearly earnings growth rate rose to11.9% with technology and communication services companies providing a significant proportion of the growth.

European equity markets were a laggard, with the Euro 100 (EUR) rising 0.6% due to uncertainty around the outcome of tariff negotiations between the US and Europe. Conversely, the Nikkei (JPY) increased by 4.1% driven by the momentum of the US and Japan reaching a trade deal and thus reducing uncertainty for investors. The Chinese market continued its rally, with the Hang Seng Index (HKD) returning 1.3%, driven by positive progress in trade talks between the US and China, as well as stimulative policies from the Chinese government.

Commodities

Gold performed strongly in August, returning 4.4% resuming its strong run driven by investor demand.

Iron ore continued its recent recovery, up 3.6% fuelled by Chinese plans to build a mega hydroelectric dam with an estimated cost of $250bn.

The lithium price also staged a recovery following the announcement that Contemporary Amperex Technology (CATL), China’s largest battery manufacturer, suspended operations at a major mine. The unexpected halt sparked immediate concerns over supply and fuelled speculation about potential broader production disruptions.

West Texas Intermediate (WTI) Crude fell 8.5% in anticipation of higher supply after OPEC+ announced it would reverse its voluntary production cuts a year earlier than planned.

Bond markets

The Australian 10-year government bond yield rose slightly to 4.29% as the RBA delivered an expected rate cut in August.

Economic developments

Reserve Bank of Australia (RBA) cuts in August

The RBA reduced the cash rate by 0.25% to 3.60%, as the Board became confident that inflation has sustainably moderated. Commentary from the RBA indicates that they are now comfortable with the level of inflation and that their policy priority is maintaining full employment in the economy.

The unemployment rate fell from 4.3% in June to 4.2% in July, as forecast by economists. Trimmed mean inflation, however, increased from 2.1% to 2.7%, well above forecasts of 2.3% as it was impacted by an increase in travel and electricity prices.

The RBA remains focused on economic data to inform its future policy decisions, and the market is currently pricing in one additional rate cut over the remainder of 2025 and two additional rate cuts in the next 12 months.

The Federal Reserve (Fed) is expected to cut in September

US equity markets and bond yields fell sharply at the start of August following data revisions that indicated that the labour market had weakened more than previously anticipated. This led investors to raise the probability of a likely rate cut in September. Fed Chair Powell highlighted the softer employment trends, signalling that the labour market would be a key focus for upcoming policy decisions. While some Fed governors have publicly supported a September rate reduction, others remain cautious, prioritising ongoing inflationary pressures over the slowing jobs market.

Producer price inflation (PPI) rose, suggesting that higher import costs driven in part by US tariffs may soon feed into consumer prices. So far, broad based increases in consumer prices have been limited, but rising producer costs could be passed on in the coming months. Trade policy uncertainty remains elevated, with several of President Trump’s tariffs facing legal challenges, including rulings against the use of the International Emergency Economic Powers Act. Concerns over Fed independence have also been raised following the controversial dismissal of Governor Lisa Cook, which may create a vacancy that could influence the Fed’s future policy direction.

The upcoming September employment report will be closely monitored, likely playing a decisive role in the timing and magnitude of the Fed’s next rate adjustment.

Outlook

Markets remain supported by resilient company fundamentals and easing monetary policy across key economies, yet policy uncertainty continues to cloud the global outlook. Investor sentiment has improved amid greater policy clarity, yet geopolitical tensions, evolving central bank stances, and uneven global growth remain key sources of potential market disruption. In this environment, a patient, flexible investment approach anchored in fundamentals remains essential.

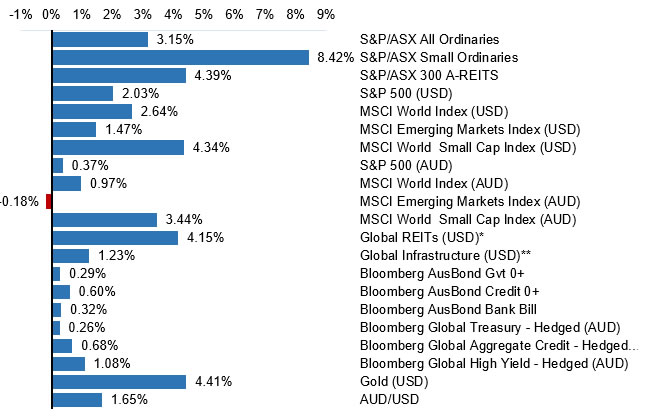

Major market indicators