Economic Snapshot

September 2025

Summary

Equity market returns were mixed in September, with global equity markets delivering reasonably strong gains, while Australian equities experienced a modest decline. Emerging Market equities were the best performers, led by Asian regions. Bond markets experienced relatively minor moves, and within Commodities, Gold rose sharply. In the US, the Federal Reserve (the Fed) cut interest rates by 25 basis points, while in Australia, the Reserve Bank of Australia (RBA) kept interest rates on hold.

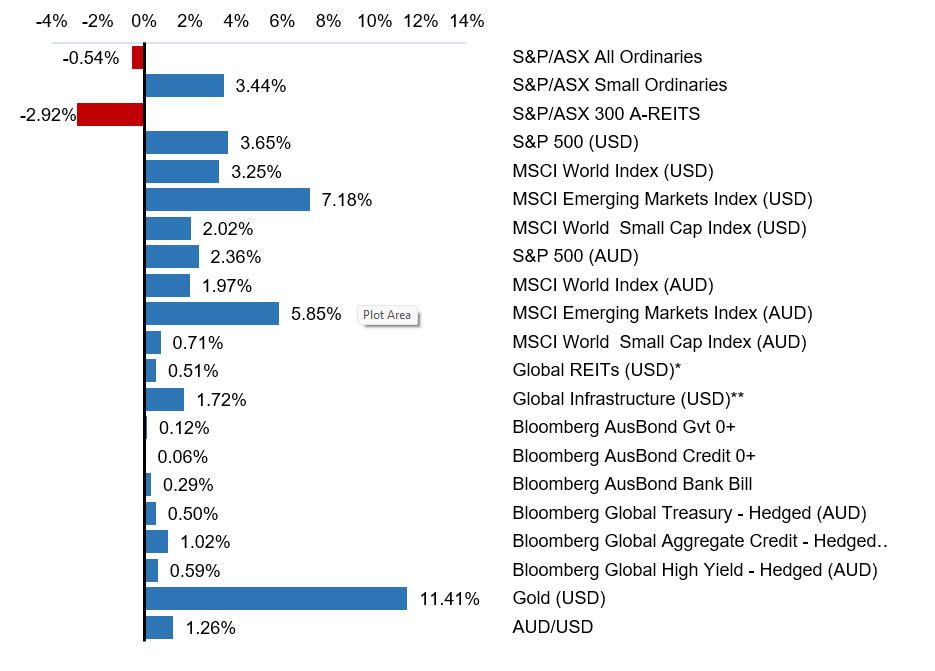

Selected market returns (%), September 2025

Sources: *FTSE EPRA/NAREIT DEVELOPED, **FTSE Global Core Infrastructure 50/50 Index

Key market and economic developments in September 2025

Financial markets

Global equity markets continued to perform strongly through September. Emerging Markets delivered particularly strong gains, up 7.18% in USD, with Asia leading the rally due to the strong performance of technology and semiconductor stocks. Bond markets experienced relatively minor movements throughout the month, and Gold had another strong month, rising 11.41%.

Australian equities

The Australian equity market experienced a moderate pullback in September, retreating from August’s record high. Weakness was broad-based across sectors, led by the energy sector, which declined by 10%. Financials also weighed on performance, with the big 4 banks declining amid ongoing concerns around interest rates, consumer sentiment, and valuations. In contrast, gold producers outperformed strongly on the back of record-high gold prices. Whilst the broad Australian equity market declined 0.54%, small companies delivered strong gains, with the S&P/ASX Small Ordinaries Index finishing the month up 3.44%.

Global equities

Global equity markets advanced in September, extending solid gains for the year to date. In the US, the S&P 500 Index (+3.65%, USD), Nasdaq Composite Index (+5.61%, USD), and Russell 2000 Index (+2.69%, USD) all experienced gains, with the telecommunications and information technology sectors leading the way.

European equities also experienced reasonable gains in September, with the Euro 100 Index (EUR) up 4.4%. Emerging markets were the best performing equity markets during the month, with notable gains coming from South Korea’s Kospi Index (+6.50%) and Taiwanese equities (+7.26%). Growth in artificial intelligence, semiconductors, and digital infrastructure underpinned the rally, with tech leaders such as Taiwan Semiconductor, Alibaba, and Samsung benefiting from surging investment in AI and chip manufacturing.

Commodities

Gold extended its rally in September, climbing toward record highs and delivering its strongest monthly performance in 14 years with an 11.41% gain. The surge was driven by renewed investor demand amid concerns over a potential US government shutdown, softer labour market data, and a weaker US dollar.

Meanwhile, West Texas Intermediate (WTI) crude oil fell 1.8%, marking its second consecutive monthly decline, pressured by surplus supply from OPEC+ and weak demand in China.

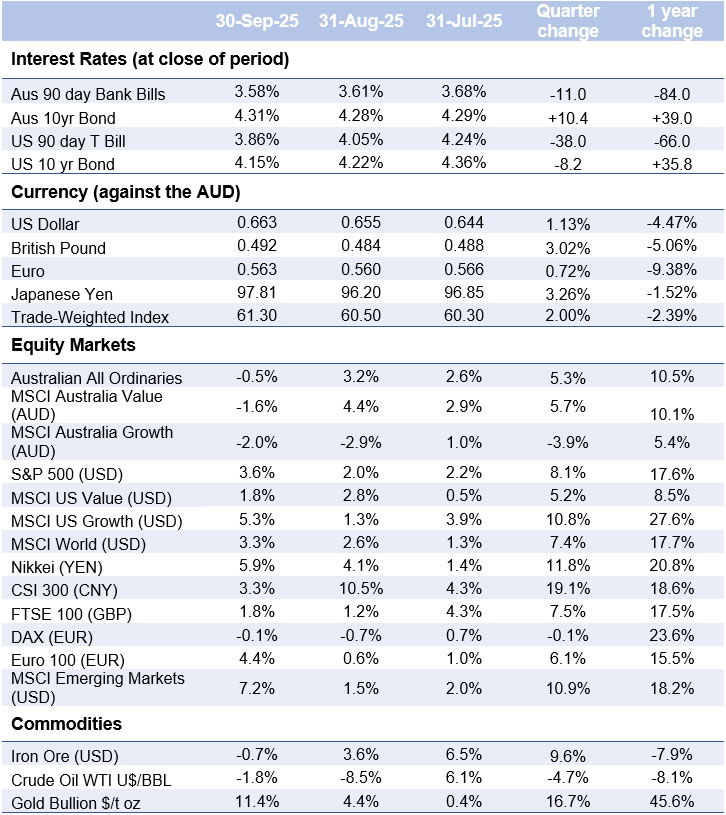

Bond markets

Australian 10-year government bond yields rose slightly to 4.31% due to stronger than expected inflation data in August.

Economic developments

The RBA kept rates on hold

The RBA kept the cash rate on hold at 3.60% at its September meeting, with any rate cuts now likely delayed. Stronger than expected inflation data for Q3 2025, indicating a trimmed mean CPI rise of around 0.9% – 1.0% quarter-on-quarter, well above the RBA’s forecast of 0.64%, has added caution to the RBA’s approach.

Private demand is recovering more rapidly than anticipated, supported by rising real household incomes, easing financial conditions, and a strengthening housing market. Labour market conditions remain stable but mildly tight, with unemployment remaining unchanged at 4.2% in August and employment growth slowing slightly.

This cautious stance reflects an evolving outlook where inflation may remain elevated near the upper end of target for some time, but overall economic activity and labour markets signal no immediate need for further tightening.

The Fed cut its policy rate by 25bps

In the US, the Fed cut its policy rate by 25bps on 17 September, in line with expectations, citing signs that economic momentum had slowed in the first half of the year. The Fed reiterated its dual mandate of promoting maximum employment and price stability, noting that risks to the labour market have increased and the broader economic outlook remains uncertain.

Policy decisions from President Trump have added further complexity. Immigration restrictions have created a negative supply shock in the labour market, while tariffs may result in inflationary pressures. Hiring has slowed significantly, though the impact on unemployment has so far been muted due to a shrinking labour force.

The Fed’s latest Summary of Economic Projections pointed to the likelihood of two additional 25bps cuts by year-end, though estimates varied widely. Fed Chair Powell stressed that the Fed remains data-dependent and has no fixed path for future moves.

Outlook

Markets remain supported by resilient company fundamentals and easing monetary policy across key economies, yet policy uncertainty continues to cloud the global outlook. Investor sentiment has improved amid greater policy clarity, yet geopolitical tensions and uneven global growth remain key sources of potential market disruption. In this environment, a patient, flexible investment approach anchored in fundamentals remains essential.

Major market indicators

Source: Quilla, Refinitiv Datastream