2025 was a strong year for equity investors, with robust gains delivered despite heightened policy uncertainty and multiple geopolitical flashpoints. The early months of President Trump’s administration proved among the most consequential in recent history, contributing to periods of elevated market volatility.

Nevertheless, strong underlying business fundamentals, including healthy business activity and continued investments in artificial intelligence, were sufficient to support earnings growth and drive markets to another year of solid returns.

Key Market and Macroeconomic Developments

January

Markets began 2025 with significant divergence in returns, with US markets experiencing a consolidation as investor sentiment shifted from expectation of the new Trump administration, to being unsettled about the rhetoric focusing on economic nationalism & culture wars. European & Chinese markets experienced strong returns, significantly outpacing other major markets as investors were drawn to cheaper valuations and attractive thematics such as defence, EVs and exciting Chinese technology developments. Global bond yields rose sharply on expectations of higher inflation and economic growth due to greater fiscal stimulus globally.

February

President Trump announced a flurry of policy moves relating to trade, immigration and a significant overhaul of the Federal Government through the creation of the Department of Government Efficiency (‘DOGE’) led by Elon Musk. International investors became more unsettled about the new Trump agenda, precipitating a rotation from US stocks into European & Chinese markets. The S&P 500 fell a modest -1.0%, with other markets benefitting, including a +14% rally in the Hang Seng Index and a +3.9% increase from the Eurostoxx 50 Index. In Australia, the ASX had a volatile reporting season with the market falling -3.8%, with many companies experiencing large one-day moves. There was an equal proportion of companies that beat, met & missed the market’s expectations, and more companies were downgraded by brokers than were upgraded, indicating some overall weakness. Defensive sectors like Utilities (+3%) & Communication Services (+2.6%) did well, while the growth orientated IT sector was the worst performer, returning -12.3%. Meanwhile, recognising easing inflation and low GDP growth, the Reserve Bank of Australia (‘RBA’) initiated its first cut to the Cash Rate since 2020, reducing rates from 4.35% to 4.10%.

March

Weakness in US equity markets continued through March, markets focussed on the steady escalation of global trade tensions. High stakes negotiations and brinkmanship from President Trump served to rattle businesses, with tariffs announced on sectors including steel and aluminium, pharmaceuticals, consumer electronics, and building materials, among others. The selling of US Equities accelerated, with the S&P 500 falling -5.8%. The US Dollar, which typically acts as a ‘safe haven’ currency, also fell by a substantial -2.9%, with investors favouring Gold as a safe haven, which broke through $3,000 for the first time to make new all-time highs. Global markets were increasingly affected, including China, Japan & Europe, all posting negative returns for the month. In response to the heightening uncertainty, economists increased their probability of a US recession, and the European Central Bank cut interest rates by 0.25%.

April

On April 2nd, President Trump announced new sweeping tariffs on all US Trade partners as part of his ‘Reciprocal Tariffs’, with tariff rates ranging from 10-49%, much higher than expected by observers. This triggered an immediate market reaction, with the S&P 500 falling -11.2% in the first week of April. Markets globally were also roiled, with the ASX 200 also declining -6.3% in early April, before recovering and finishing the month up +3.6%. The sell-off was halted when US Treasury Secretary Scott Bessent intervened with President Trump, highlighting the risks to the stability of the US Dollar and US Treasury Market, where bond yields had become disorderly. A 90-day pause on implementing tariffs gave room for the US and its major trade partners to begin negotiations and avoid a worst-case scenario.

May

The fragile trade truce begun in mid-April was buttressed further by an agreement between China & the US through negotiations in Geneva. This reduced the tariffs, which had been at punitive levels, to much more moderate levels. This allowed a continued recovery in global markets, with the MSCI World up 5.4%. The enduring phrase ‘TACO’ was born, standing for ‘Trump Always Chickens Out’. This encapsulated the view taking hold, that President Trump tends to talk aggressively but will always back-down if he encountered strong resistance. In geopolitical events, a brief but intense conflict erupted between India & Pakistan, which was quickly de-escalated by both parties, showing the many geopolitical risks. In Australia, the RBA again cut interest rates by 0.25% citing external risks to the economy, improving inflation and sluggish economic growth. The ASX continued to recover from its weak start to the year and gained +4.2% led by a recovery in the IT sector and strong performance from gold miners.

June

Financial markets continued to advance in June, as markets increasingly turned their focus from tariffs to other matters, such as the booming level of investment in data centres and developments in AI. The Technology heavy Nasdaq 100 Index rose 4.4% in June, while the S&P 500 regained the all-time high it reached in February. East Asian markets had some of their best months on record, with the South Korean KOSPI Index up a remarkable +14.3%, as well as strong gains for Taiwan (+7.3%) & Japan (+4.7%). Oil prices rose sharply from $62 per barrel for Brent Crude to a high of $81 on June 23rd, as the shadow war between Israel & Iran burst into the public consciousness over a 12-day conflict. Israel displayed its regional military dominance with some assistance from the US, damaging Iran’s nuclear facilities and conventional military capability, but leading to fears of spillover into oil markets. However, de-escalation in late June meant that it never came to pass and energy prices retraced accordingly.

July

Equity markets continued to push sharply higher, with several markets making new all-time highs. The MSCI World advanced a substantial +3.1%, largely driven by the US, while the MSCI Emerging Market Index was up +3.8% with continued strength from East Asia. Fiscal stimulus was provided from President Trump’s budget, the ‘One Big Beautiful Bill’ (‘OBBB’), which passed both houses of Congress to be signed on July 4th. The OBBB extended and increased tax cuts to US households, giving an expected boost to the economy starting in 2026. Although bond investors noted that this came at the cost of increasing expected budget deficits by $3.3T over the decade, elevating risks around the increasing national debt and fiscal sustainability.

August

ASX reporting season through August led to a positive but volatile month, with companies again exhibiting large single day moves when reporting their annual results. Value-style stocks (+7.1%) performed strongly, well in advance of Growth (-2.9%), while the Small Ordinaries index (+8.4%) considerably outperformed the broader ASX 200 Index (+3.1%). Resources were the best performing sector, with the largest contributors being gold miners, while Healthcare stocks (-16%) continued their weak run of performance. ASX heavyweight CSL had its worst day on record, falling -15% and finishing the month down -21.7%, while other healthcare companies also fell substantially, including Telix Pharmaceuticals (-30.6%), Sonic Healthcare (-12.9%) and Pro Medicus (-7.5%).

September

Global equity markets surged in September with big advances across technology sectors as part of the ongoing AI boom. Deals were announced between major players in the sector, including a $100b partnership between OpenAI and Nvidia announced on September 22, and the $500b ‘Stargate’ data centre complex in Texas announced by Oracle. These highlight the spectacular level of investment required to build out AI capabilities. These rippled across the technology supply chain, with producers of technology equipment, semiconductor chips and energy infrastructure all experiencing record levels of demand. Asian markets continued to be the primary beneficiaries as well as US Technology firms, with the Nasdaq 100 Index up another +4.2% while the MSCI Emerging Market Index up a hefty +5.8% during the month. Markets with less exposure to technology themes, such as Australia or Europe, were notably weaker, with the ASX 200 down -0.8% for the month and the UK’s FTSE 100 up only +0.2%. In the US, the US Federal Reserve cut rates for the first time in 2025, citing a slowing labour market and improving inflation. This change came after pressure from President Trump, leading to some speculation about the Fed’s independence from the White House.

October

October was another very strong month for global equities, with developed and emerging market companies continuing to rapidly push higher. However, the month was not without challenges, with a US Government shutdown that began on October 1, instigated by the Democratic Senate caucus, protesting cuts to Federal healthcare and social benefits. The shutdown led to interruptions in the collection of economic data, causing concern to investors and Central Banks, who rely heavily on official economic data. Despite the interruption of official inflation and labour market data, the US Fed cut rates again in late October, taking the new policy rate to 3.75% – 4.0%. Along with the advancing equity markets, Gold broke through $4,000 for the first time and making new all-time highs, highlighting strong demand from investors seeking returns and diversification.

November

Markets finally cooled in November, after consecutive months of strong growth across global equity markets. The ASX 200 fell by -2.7%, led lower by weaker technology companies and the healthcare sector. The developed MSCI World index was flat while Emerging markets fell -2.5%. Speculative assets were hit hardest, such as Bitcoin which fell -16.5%. The US Q3 Reporting Season wrapped up in November, with companies reporting very strong annual earnings growth of 14%, well ahead of analyst expectations. The ‘Magnificent 7’ mega-cap technology companies continued to deliver strong results, growing faster than the rest of the market with annual earnings growth of 21%, showing their remarkable business models and level of market dominance.

December

Markets finished 2025 with another muted month, with markets mostly flat for the month. East Asian markets were again the best performers, after a historic year for Korea & Taiwan, especially, driven by booming AI demand for semiconductor chips. The US S&P 500 ended the year with a USD return of +16.4%, a remarkable recovery from the extreme weakness experienced in the first months of the year. The US Fed again cut rates, as did the Bank of England, as Central Bankers continue to be confident that inflation is coming under control. The RBA held rates steady in its December meeting but noted that higher inflation in recent months was concerning. This led to speculation about possible Australian rate hikes in 2026, posing a risk to the economy. The prospect of higher rates led to a rally in the Australian Dollar to $0.67, its highest level since 2024.

Outlook

We remain optimistic on the outlook for markets, with most major economies experiencing reasonable economic growth despite various complex issues being navigated. While there are many risks, we believe that the global economy will continue to perform well and that companies are well positioned to continue to grow their earnings in 2026 and beyond.

Equity returns may not be as strong in 2026 as they were in 2025, however that does not overly concern us. We also note that other asset classes also look reasonably attractive;

including government bonds, credit, property, infrastructure & alternatives. Under these circumstances, we are optimistic that a robust, diversified portfolio can continue to deliver attractive real returns over the medium and long term.

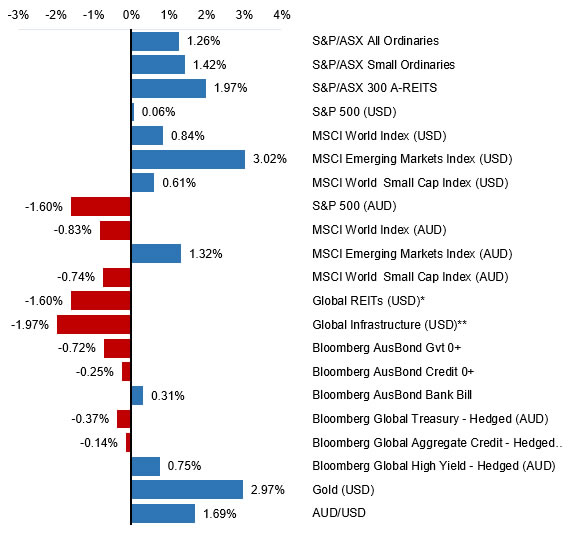

Selected market returns (%)

December 2025

Sources: *FTSE EPRA/NAREIT DEVELOPED, **FTSE Global Core Infrastructure 50/50 Index

Key Market and Economic Developments since December 2025

Financial markets

Markets were largely resilient through December, with pockets of strength enhancing returns for investors. Appreciation of the AUD negated local currency returns from developed global equities. This was offset by positive returns from the Australian market, along with continued strength from emerging markets.

Australian equities

The S&P/ASX All Ordinaries Index was up 1.26% in December, finishing the year with a return of +10.56%, in line with the long-run average excluding franking credits.

The Australian resources sector was the largest contributor to returns in December, as commodity prices continued to improve. Healthcare was the biggest detractor as large Australian healthcare businesses such as CSL and Cochlear remain under pressure, in line with the struggling global healthcare sector.

The S&P/ASX Small Ordinaries Index was also up, rising +1.42% with similar drivers, being higher prices in gold, lithium and copper, benefiting miners while other sectors were mixed.

Global equities

US markets lagged other global markets in December, with the S&P 500 down -1.60% in AUD terms. Most large developed markets were positive, including strong months in the

UK, Japan, France & Germany, as value and cyclical factors outperformed for the month. Many markets remain at or near their record highs, after several years of strong positive returns in a row.

Within Emerging Markets, the South Korean KOSPI Index was the standout as chip giants Samsung Electronics and SK Hynix are increasingly benefiting from a critical shortage in memory chips, as the AI boom takes a large and increasing share of global

supply. This has led to substantial increases in prices, which will likely flow through to price pressure for consumer electronics like phones and computers. The Korean market was up a remarkable +7.2% in AUD terms in December as a result.

The Emerging Markets Index was up

1.3% in AUD terms, with the Chinese market slightly weaker, while South Korea and South Africa performed, the latter supported by the gold price.

Commodities

As noted, gold continued moving higher, ending the month up 3% in USD terms, with a new geopolitical flashpoint in Venezuela

contributing to tensions benefiting gold, along with the support from the falling USD.

Industrial commodities, including iron ore and copper, also moved higher as global

economic growth has continued to be resilient boosting demand. Iron Ore was up a modest

+1.7%. However, Copper, which is supported by a more favourable supply and demand picture, continued to make new record highs and was up +9% for the month.

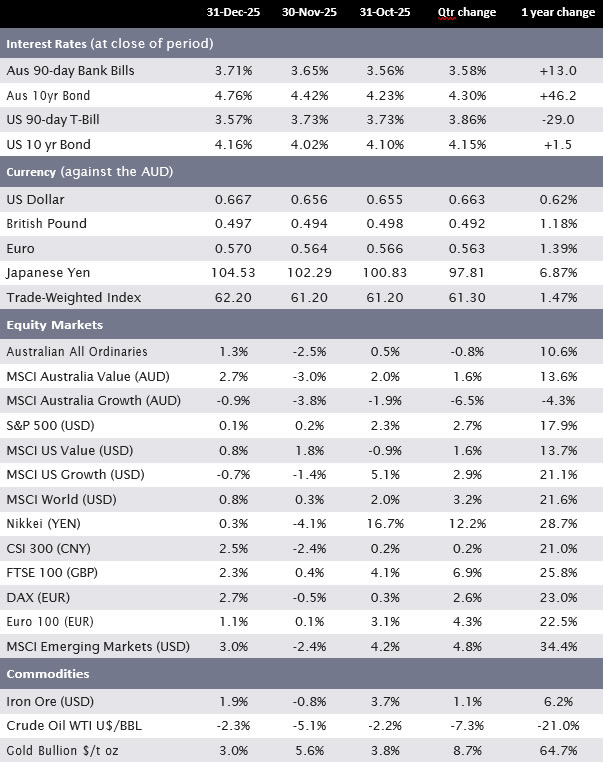

Bond markets

Fixed Income markets were slightly weaker during the month, with bond yields increasing despite the interest rate cut being delivered by the US Fed. Longer-dated bond yields have continued to stay stubbornly higher

in the US, with the 30-Year Treasury Bond finishing the year with a yield of 4.80%. In Australia, yields have also continued to push higher as stubborn inflation and speculation of possible interest rate hikes in 2026 have caused some nervousness. Investors now require a yield premium to hold Australian Government Bonds, with 20 and 30-year bond yields trading at 5.2-5.3%, higher than that of peer countries.

Within credit markets, activity has been benign. This was an attractive area for investors through 2025 as overall yields to investors were strong compared to history, while defaults have been rare – leading to a positive overall return profile.

Economic developments

US Fed cuts rates again

The US Fed cut interest rates for a third time in 2025, reducing the target rate to 3.50-3.75%. The key points in the Fed’s statement highlight the challenge of managing their dual mandate. Job creation slowed in 2025 to a very low level, causing some concerns from policymakers about the health of the economy. This is in direct conflict with their objective to return inflation to the Fed’s 2% target, which remains elusive.

Commentary from Fed Chairman Jerome Powell indicates they are happy to look through the impact from tariffs on inflation, under the belief that this will be a one-off increase rather than ongoing. Keen market watchers will remember similar logic in 2021, when inflation was thought to be ‘transitory’, which failed to understand the building inflation pressure. The Fed in 2026 is no doubt very aware of not repeating this mistake.

The outlook from economists and the market suggests there may be some more modest easing in 2026, although the timing and magnitude are of course uncertain. The December Dot Plot, a chart of where Fed members believe interest rates should be in future, indicates interest rates may slowly drift lower over 2026 and 2027. One unknown

will be who President Trump nominates for Fed Governor to replace Jerome Powell from May 2026.

New geopolitical flashpoint

The ongoing military buildup and pressure campaign seeking to oust President Maduro, which built in late 2025 and subsequently resulted in the US capture of Maduro on January 3rd, heightening tensions and fears of spillover to markets. However, as of yet this hasn’t been reflected in significant volatility in oil prices despite Venezuela’s OPEC member status and the potential of its enormous oil reserves.

Oil prices steadily fell through 2025, finishing the year with Brent Crude at ~US$61, well under the price at the start of 2025 of US$74. This is despite several conflicts involving major oil producing nations including the Russia-Ukraine war, where oil & gas assets are routinely targeted, the Iran-Israel conflict, and now a likely US confrontation involving Venezuela.

The reason for the sustained weakness in oil prices is a significant market oversupply. This has been led by Saudi Arabia as well as non-OPEC countries including the US, Brazil & Guyana (Venezuela’s neighbour).

This increased supply has been met with only modest demand growth, leading the International Energy Agency to forecast a

record surplus of crude oil in 2026, totalling 4 million barrels per day in excess supply. Unless supply and demand levels rebalance, this will likely have the effect of further weakening prices and leading to excessive oil inventories.

The broader impact on the economy could be helpful to tame inflation and give businesses and households some relief from recent energy price increases.

Major market indicators

Sources: Quilla, Refinitiv Datastream

Important information

Quilla Consulting Pty Ltd (Quilla) holds AFSL 511401. This document provides general advice only and not personal financial advice. It does not take into account your objectives, financial situation or needs. Before acting or making any investment decision, you should consider your personal financial situation or needs, consult a professional adviser, and consider any applicable disclosure documents.

Information in this document is based on sources believed to be reliable, but Quilla does not guarantee its accuracy. All opinions expressed are honestly held as at the applicable date. Neither the information, nor any opinion expressed, constitutes an offer, or invitation, to buy or sell any financial products.

Quilla does not accept any liability to any person or institution who relies on this document and the information it contains and shall not be liable for any loss or damage caused to any person in respect of this document and the information it contains. You must not copy, modify, sell, distribute, adapt, publish, frame, reproduce or otherwise use any of the information in this document without the prior written consent of Quilla.