Summary

The Trump administration announced reciprocal tariffs in early April, in what was labelled ‘Liberation Day’. The scale of tariffs was much higher than expected, triggering a plunge in global equity markets and a spike in volatility to the highest levels in five years. Concerns of a potential US recession and resurgent inflation fuelled these reactions. Equity markets subsequently stabilised and recovered most post-announcement losses as the administration delayed numerous tariffs and granted exemptions, coinciding with many countries proactively entering trade negotiations. Domestically, a moderate quarterly inflation report boosted expectations for a post-election interest rate cut.

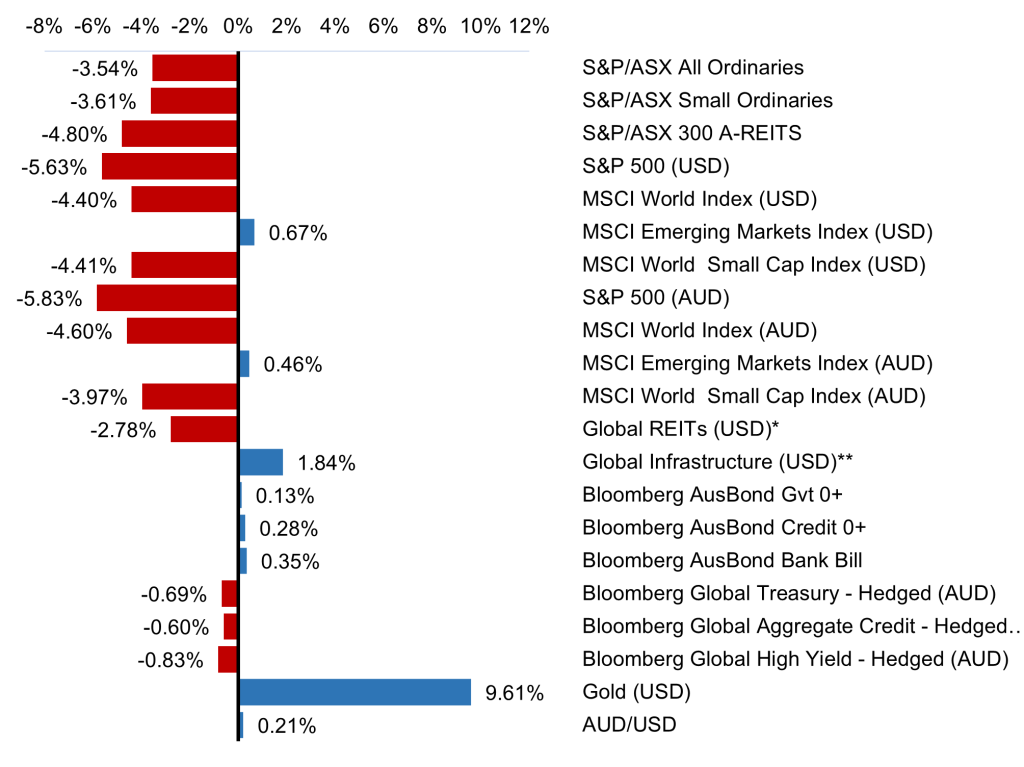

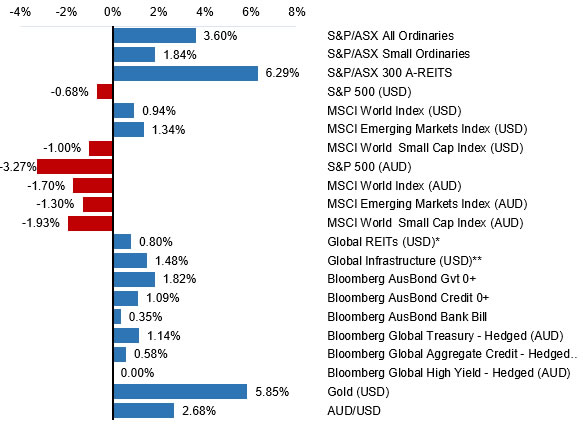

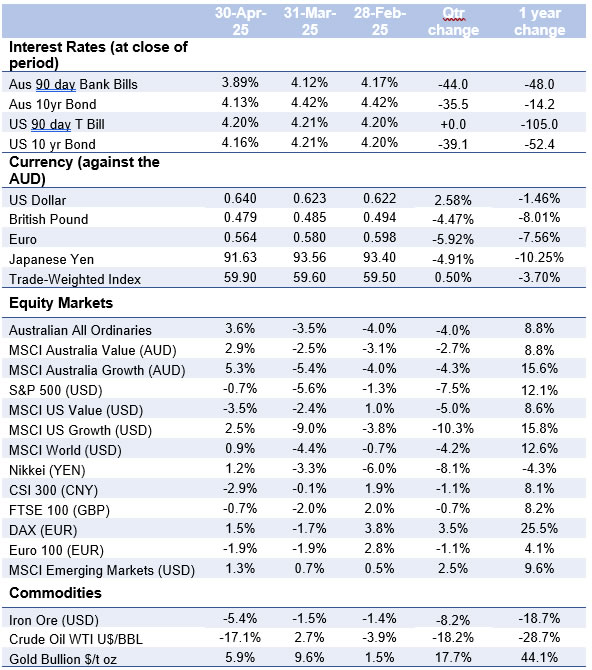

Selected market returns (%), April 2025

Sources: *FTSE EPRA/NAREIT DEVELOPED, **FTSE Global Core Infrastructure 50/50 Index

Key market and economic developments in April 2025

Financial markets

Australian equities

Global equities

European equity markets were broadly weaker, with the Euro 100 (EUR) decreasing by 1.9%. The German DAX (EUR), however, continued its trend of relative strength, advancing 1.5%. The CSI 300 (CNY) fell 2.9% as Chinese equities were negatively affected by the US tariff news. Nevertheless, the broader MSCI Emerging Markets (USD) registered a gain of 1.3%, bolstered by a strong rally in Indian equities as the Nifty 50 (INR) rose by 3.5%, supported by perceived progress in trade negotiations with the US.

Commodities

A weaker US dollar in April did not translate into broad support for commodity prices. Gold, however, continued its upward trend driven by safe-haven demand, rising 5.9% to close the month at $3308 per ounce. Global economic growth concerns weighed on the demand outlook for crude oil, leading to a substantial decline of 17.1% to $58.15 per barrel. Similarly, base metals saw price weakness, with copper prices dropping 8.3% and iron ore falling 5.4%.

Bond markets

April saw considerable volatility in bond markets. The benchmark US 10-year Treasury yield experienced a large intra-month trading range of 60 basis points but ultimately closed the month 5 basis points lower at 4.16%. This volatility reflected investors’ efforts to reconcile the potential inflationary impacts of US tariffs, which could push yields higher, against a weakening economic growth outlook that would typically pressure yields downwards. The elevated level of bond market volatility ultimately proved crucial to the US administration softening its tariff implementation in the week that followed ‘liberation day’.

Domestically, the benchmark Australian 10-year bond yield declined by 29 basis points, ending the month at 4.13%. The Australian bond market focused more on the evolving domestic inflation outlook and its potential implications for the future path of interest rates, rather than being swayed by global uncertainties.

Economic developments

Inflation data raises the likelihood of an RBA rate cut

Australia’s core trimmed mean Consumer Price Index (CPI), the Reserve Bank of Australia’s (RBA) preferred underlying inflation measure, registered 2.9% year-on-year, moderating from 3.2%. This aligned with the RBA’s February forecast and marked a return to the 2-3% target band for the first time since late 2021. Headline CPI held steady at 2.4%, showing further moderation in some stickier components like new dwelling prices, while insurance premiums saw their slowest rise since 2022. These outcomes strengthen the case for a 25 basis point rate cut in May.

The Australian labour market remained resilient, with the unemployment rate remaining close to full employment at ~4%. Positively, employment grew by 32,200, with measures of underemployment and youth unemployment improving marginally. However, job advertisements fell for the second consecutive month, indicating future potential softening.

The Westpac-Melbourne Institute Consumer Sentiment Index fell 6% in April, driven by weaker finance and employment outlooks. Notably, consumers surveyed after President Trump’s tariff announcement reported a 10% drop in confidence compared to a 2.1% fall among those surveyed prior.

Tariffs weigh on the global economic outlook

Tariff-induced uncertainty negatively impacted US economic data. Preliminary Q1 US Gross Domestic Product (GDP) contracted at an annualised rate of -0.3%, missing the 0.2% forecast, primarily due to a sharp fall in net exports and slower consumption reflecting decreased confidence. Business investment did rise, partly boosted by tariff-related inventory building.

The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) Price Index, slowed to 2.3% year-on-year from 2.7%, slightly above the 2.2% expectation. While a positive outcome for the interest rate outlook, forward-looking inflation expectations have increased in line with tariff increases. The labour market remained resilient, with a stronger-than-expected 228,000 increase in payrolls and unemployment up slightly to 4.2%.

The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI) dropped sharply to 50.8 from 53.5, missing expectations and highlighting a slowdown in the US services sector. The report noted significantly slower new orders and notable employment weakness.

Consumer confidence declined for a fifth straight month to 86.0 from 92.9. Consumers rated short-term business and personal income prospects at the lowest level since 2011. Small business sentiment also weakened, extending its post-election reversal amid rising policy risks.

Despite a better-than-expected preliminary Q1 Eurozone GDP expansion of 1.2% and a European Central Bank (ECB) rate cut of 0.25%, Eurozone sentiment deteriorated sharply. Economic sentiment slumped in April to -18.5 from 39.8, the largest decline since Russia invaded Ukraine in 2022. The outlook for Germany remains deeply pessimistic, weighed down by rapidly shifting US trade policy.

Outlook

Looking ahead, investor vigilance is crucial as global economic and political developments continue to drive market sentiment. Tariffs will remain a key focus, and markets are likely to react positively to any significant de-escalation or hints of pro-growth policy shifts from the US administration. However, prolonged trade tensions increase the risk of a deeper US economic slowdown. The Australian economic outlook appears more favourable, less exposed to tariff fallout and supported by expected monetary policy easing.

The evolving economic and policy landscape in both the US and Australia underscores the importance of flexibility and active management in navigating market volatility.

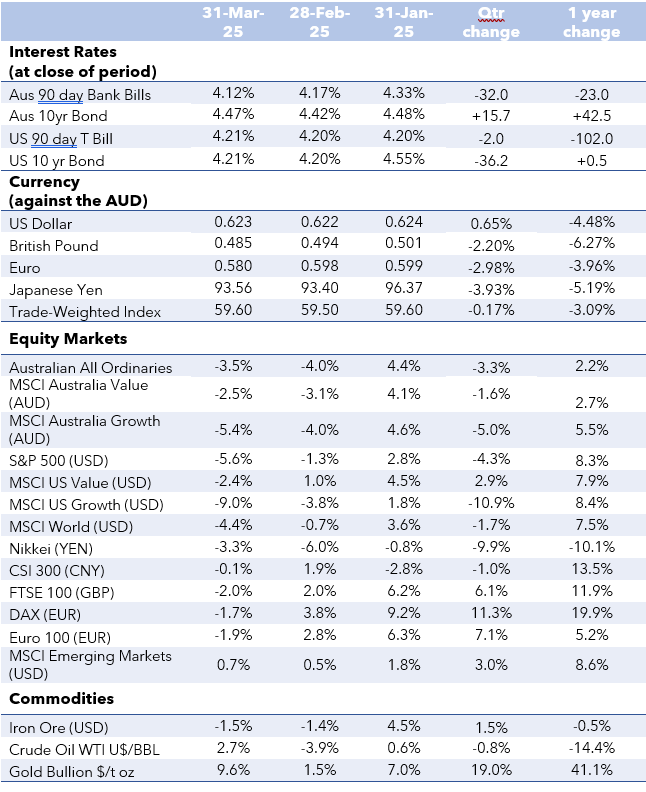

Major market indicators

Sources: Quilla, Refinitiv Datastream